Introduction to Bitcoin Whales

Bitcoin, the pioneering cryptocurrency, has its unique ecosystem governed by various entities. Among these are the enigmatic figures known as Bitcoin Whales. In this article, we delve into the realm of Bitcoin Whales, exploring their significance and characteristics and how to identify them within the crypto space.

1.1 What are Bitcoin Whales?

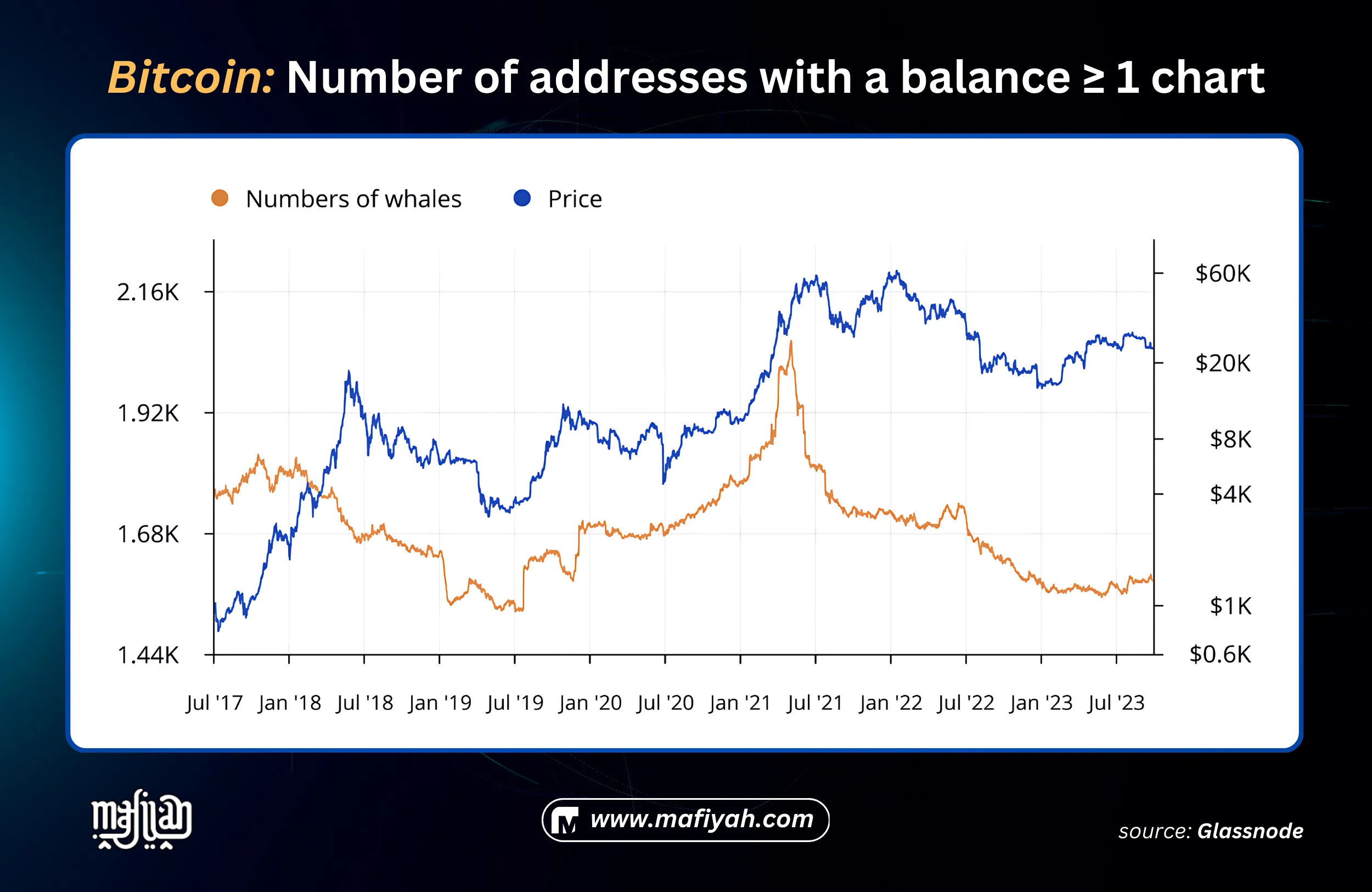

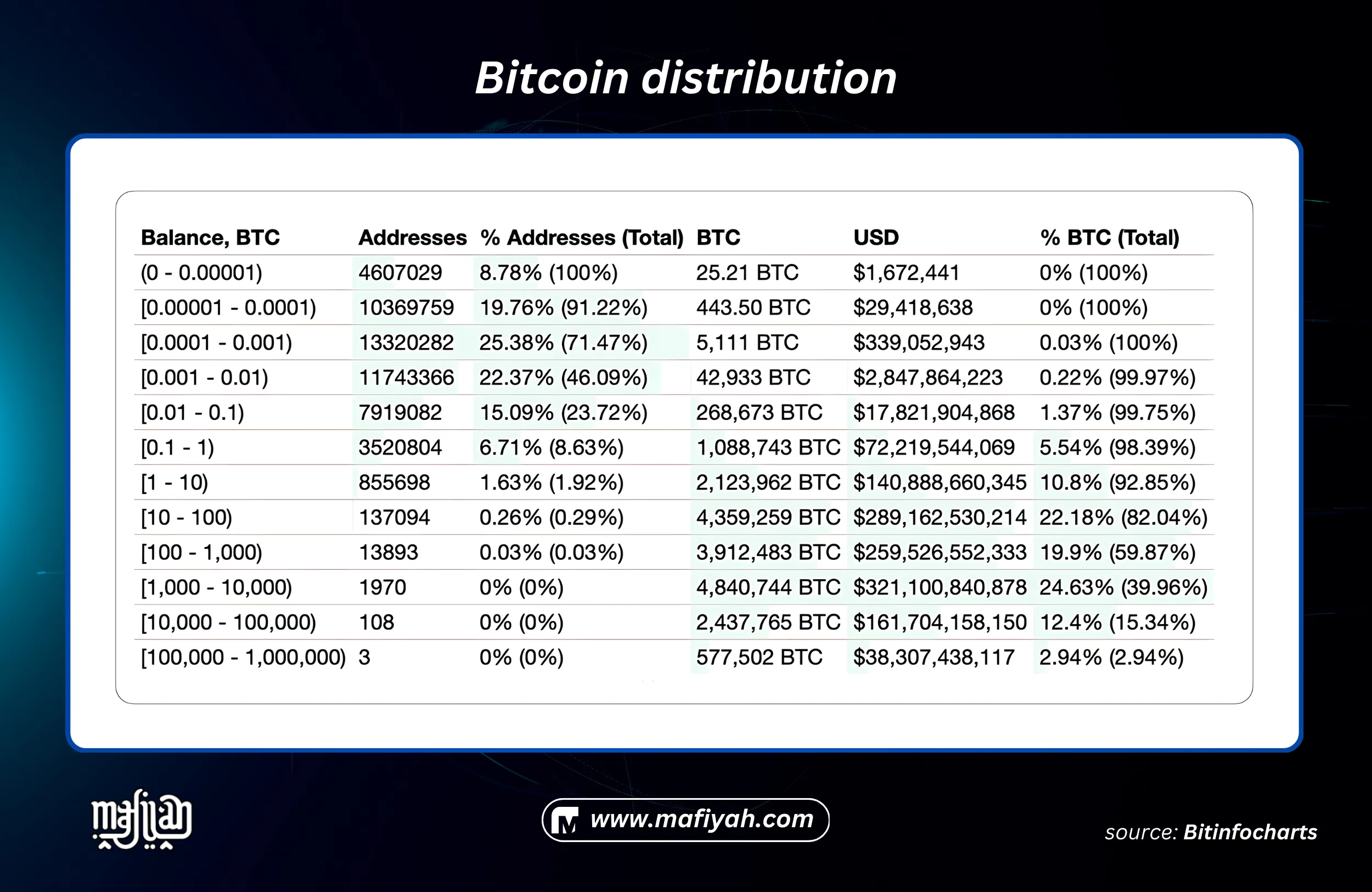

Bitcoin Whales represent individuals or entities holding substantial quantities of Bitcoin, often referred to as “whales” due to their immense influence within the crypto market. These whales typically possess tens of thousands to millions of Bitcoins in their wallets, exerting considerable power over market movements.

1.2 Importance of Bitcoin Whales

Understanding Bitcoin Whales is paramount for both seasoned investors and newcomers to the crypto space. These entities significantly impact market dynamics, shaping trends and influencing investor sentiment. Consequently, identifying and comprehending their activities can provide invaluable insights for navigating the volatile crypto market.

Characteristics of Bitcoin Whales

Bitcoin Whales exhibit distinct traits that set them apart within the crypto ecosystem.

2.1 Ownership of Large Amounts

One defining characteristic of Bitcoin Whales is their possession of large quantities of Bitcoin. These entities often hold millions of dollars worth of cryptocurrency, granting them significant leverage over market movements.

2.2 Influence on Market Trends

Bitcoin Whales wield considerable influence over market trends, capable of triggering widespread fluctuations in Bitcoin’s price through large-scale transactions or strategic trading maneuvers.

How to Spot Bitcoin Whales

Identifying Bitcoin Whales amidst the vast ocean of crypto transactions requires a keen eye and strategic analysis.

3.1 Tracking Large Transactions

One method for spotting Bitcoin Whales involves monitoring large transactions on the blockchain. By tracking sizable transfers of Bitcoin between wallets, analysts can identify potential whale activity and anticipate market movements.

3.2 Analyzing Wallet Addresses

Analyzing wallet addresses associated with significant Bitcoin holdings can also unveil the presence of whales. By scrutinizing the transaction history and balance of these addresses, researchers can gain insights into whale behavior and market influence.

3.3 Monitoring Market Movements

Monitoring market movements and identifying correlations with whale activity can provide further clues for spotting these influential entities. Sudden surges or dips in Bitcoin’s price may coincide with whale transactions, signaling their impact on market dynamics.

Impacts of Bitcoin Whales on the Market

The presence of Bitcoin Whales exerts profound effects on the crypto market, shaping its volatility and trajectory.

4.1 Price Volatility

Bitcoin Whales’ significant holdings enable them to initiate large-scale trades, contributing to heightened price volatility. Their buying or selling activities can trigger rapid price fluctuations, influencing investor sentiment and market stability.

4.2 Market Manipulation

While Bitcoin Whales play a pivotal role in the market, their actions also raise concerns regarding potential market manipulation. By strategically timing trades or coordinating efforts with other whales, these entities can manipulate prices to their advantage, impacting smaller investors and market integrity.

Risks and Benefits of Bitcoin Whales

The involvement of Bitcoin Whales presents both risks and benefits to the crypto ecosystem.

5.1 Risks of Whale Activities

Whale activities pose risks to smaller investors, as their large-scale trades can exacerbate price volatility and lead to significant market fluctuations. Additionally, the concentration of wealth among whales may contribute to centralization concerns within the crypto space.

5.2 Benefits of Whale Involvement

Despite the risks, the participation of Bitcoin Whales also brings benefits to the market. Their substantial investments can inject liquidity into the ecosystem, fostering market growth and stability. Moreover, whales often fund innovative projects and contribute to the development of the broader crypto industry.

The Role of Bitcoin Whales in the Crypto Ecosystem

Bitcoin Whales play a multifaceted role in shaping the dynamics of the crypto ecosystem.

6.1 Shaping Market Sentiment

By virtue of their substantial holdings, Bitcoin Whales influence market sentiment and investor confidence. Their actions and public statements can sway market perceptions, driving trends and shaping the narrative surrounding Bitcoin and other cryptocurrencies.

6.2 Funding Crypto Projects

In addition to their influence on market dynamics, Bitcoin Whales play a crucial role in funding crypto projects and initiatives. Through investments and partnerships, whales support the development of blockchain technology and drive innovation within the crypto space.

Strategies for Dealing with Bitcoin Whales

Navigating the crypto market in the presence of Bitcoin Whales requires strategic planning and risk management.

7.1 Diversification

One strategy for mitigating the impact of Bitcoin Whales involves diversifying investment portfolios. By spreading investments across different assets and sectors, investors can reduce their exposure to whale-induced volatility and safeguard against market fluctuations.

7.2 Long-Term Investment Approach

Adopting a long-term investment approach can also help investors weather the effects of whale activity. By focusing on the fundamentals of blockchain technology and the underlying utility of cryptocurrencies, investors can maintain perspective amid short-term market fluctuations driven by whale behavior.

Exchange BTC

Conclusion

In conclusion, Bitcoin Whales wield significant influence within the crypto ecosystem, shaping market trends and impacting investor sentiment. While their activities carry inherent risks, such as price volatility and market manipulation, the participation of whales also brings benefits, including liquidity injection and project funding. By understanding the characteristics of Bitcoin Whales and employing strategic investment strategies, market participants can navigate the crypto landscape with greater confidence and resilience.