In this article, we will summarize crypto derivatives, options, and futures. What are crypto derivatives? Crypto derivatives are financial contracts that derive their value from an underlying cryptocurrency asset. Discover the main types of trading, such as options and futures, and learn if you should trade them.

Important points:

- The value of derivatives is based on an underlying asset, like a cryptocurrency, making them tradeable financial contracts. This allows traders to participate in an asset’s price movement without owning it.

- There are two main types of crypto derivatives: futures contracts and options contracts. Crypto markets have a unique type of futures contract called perpetual futures.

- Crypto derivatives are primarily utilized for hedging and speculating. They are complicated and most suitable for skilled traders.

Can you explain derivatives to me?

Dating back to ancient Babylonian times, derivatives have a rich history. Their value is derived from an underlying asset, making these financial contracts tradeable. Nowadays, derivatives are a common feature in financial markets, including cryptocurrency.

By using derivatives, traders can experience an asset’s price movement without the need for ownership. Traders in the crypto market now heavily rely on cryptocurrencies for hedging and speculation purposes. Crypto markets have two common types of derivative contracts: futures and options. Perpetual futures, exclusive to crypto, are a special kind of futures contract.

From March 2024 onwards, Crypto.com users in select regions can now trade crypto derivatives directly within the app.

Common Derivative Contracts

Futures

Futures are crypto derivative contracts that outline an agreement between a buyer and seller to trade a particular asset (like a cryptocurrency) at an agreed-upon price and future date. When the contract reaches its expiration date, both the buyer and seller have obligations to fulfill – the buyer to purchase and receive the asset, and the seller to sell and deliver it.

In today’s financial and crypto markets, futures contracts allow exposure to price movements without physical delivery of the asset. Instead, the trade’s profit or loss would be recorded in the trader’s account (often called cash settlement).

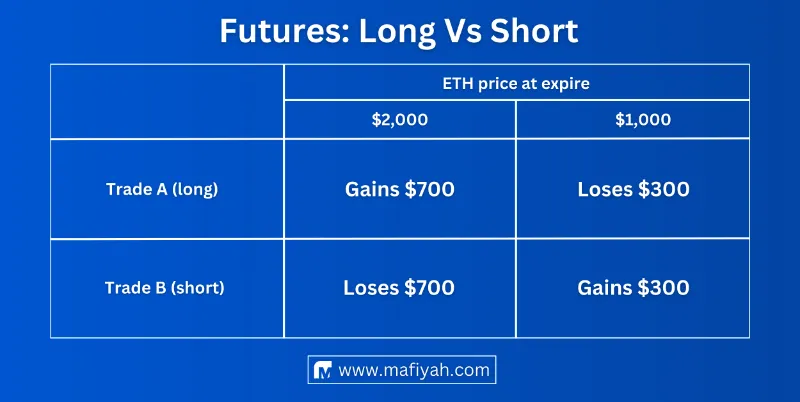

Long vs Short — When buying futures contracts, it’s called going long, whereas selling futures contracts is called going short. Long positions result in profits if the asset’s market price is higher than the set price at expiry. If the market price is lower than the set price, they suffer a loss. However, short positions are profitable if the market price is lower than the set price at expiry, but result in losses if the market price is higher.

Consider the scenario where Trader A buys a crypto futures contract with ETH as the underlying asset at a price of $1,300. Taking the opposite stance is Trader B, who is shorting the contract. To keep things simple, we won’t consider the influence of margin and leverage.

Margin — Traders don’t have to fully fund their crypto futures trades because they can trade on margin. Instead, a loan is obtained from the exchange or trading platform for a portion of the funds. Leverage provides an opportunity for increased gains, but it also carries the risk of amplified losses. The trader may also have to deal with margin calls and forced liquidation.

Perpetual Futures — In the world of cryptocurrencies, Perpetual Futures contracts stand out as a unique type of futures contract. The mechanics are similar to futures, except that perpetual futures do not have an expiry date. Traders have the freedom to hold contracts for any duration, either by choice or due to margin complications.

Options

Crypto options are a type of crypto derivative contract agreement that gives the holder the right (i.e., the option), but not the obligation, to buy or sell a specific underlying asset (such as a cryptocurrency) at a set price (referred to as the strike price) up until a set future date (also known as the expiry date).

There are two primary types of options: call options and put options. Both buying and selling the option enable entering into either a long or short position.

Due to the small fee for holding the option in relation to the contract value, they are also classified as leveraged instruments. Like futures, options can also have cash settlement. The option buyer pays the seller an amount called the premium.

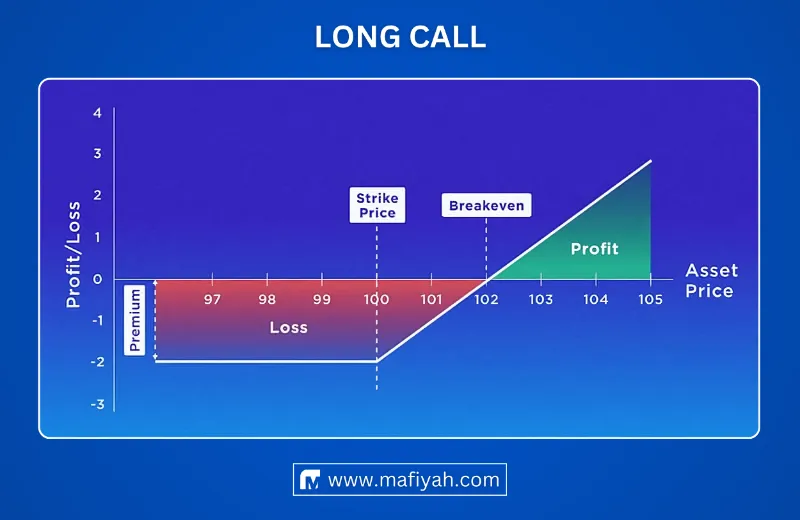

Long Call Option– In options trading, a long call option grants the holder the valuable right to buy an asset at the agreed-upon strike price, a privilege exercisable until the specified expiry date. To initiate this option, the buyer (holder) pays a premium to the seller (option writer).

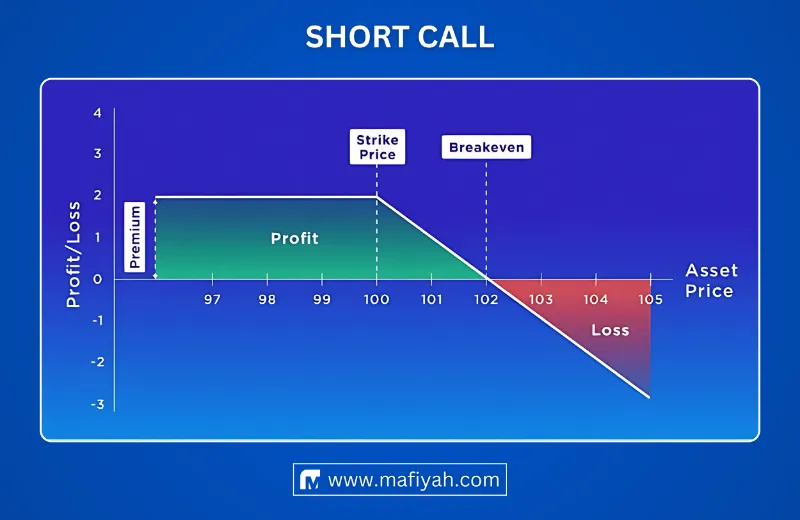

Short Call Option– Opting for a short call involves selling a call option, allowing the seller to receive a premium from the buyer (option holder). However, the seller becomes obligated to sell the asset to the option holder at the agreed-upon strike price, exercisable at any time until the expiry date.

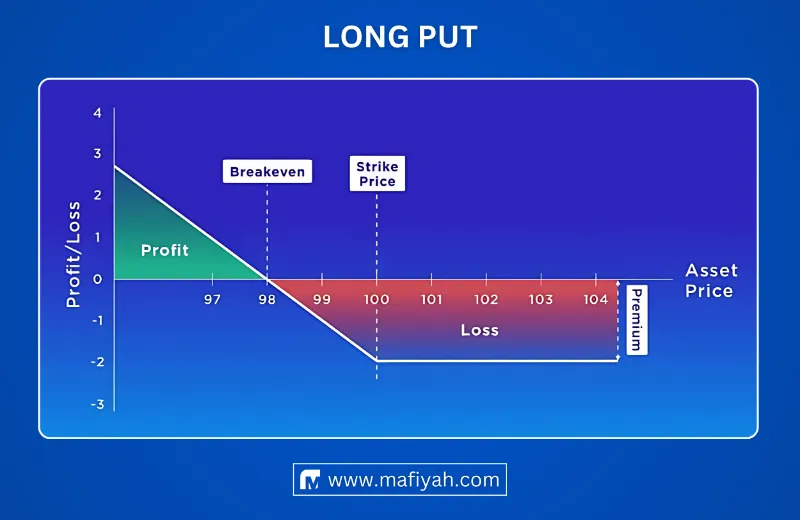

Long Put Option– A long put option provides the holder with the right to sell an asset at the predetermined strike price, exercisable at any time until the expiry date. To acquire this option, the buyer pays a premium to the seller (option writer).

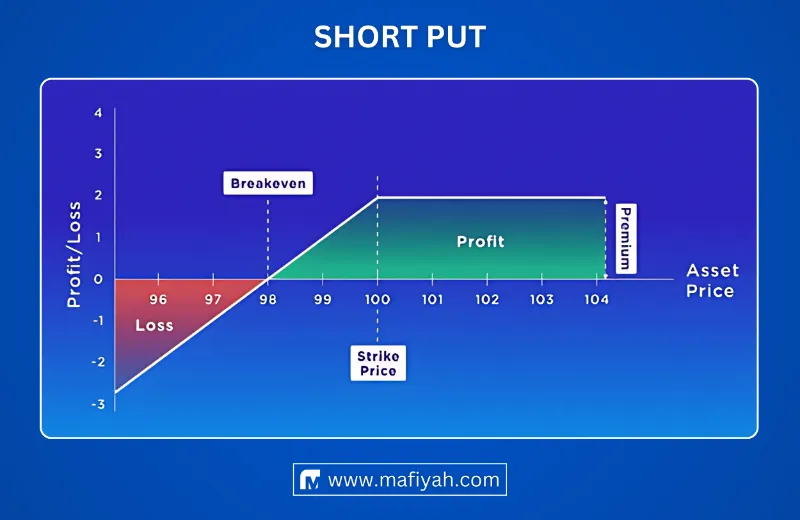

Short Put Option– Choosing a short put means selling a put option and receiving a premium from the buyer (option holder). In return, the seller is obligated to buy the asset from the option holder at the strike price, exercisable at any time until the expiry date.

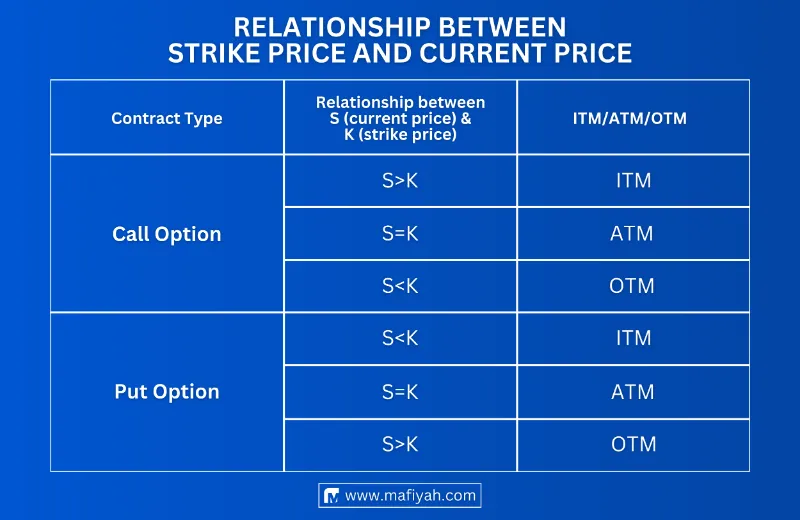

The option holder for crypto can determine whether or not to exercise their option at any time before it expires. The decision is greatly influenced by the relationship between the market price and the strike price, as it determines the outcome of exercising the option in terms of profit or loss.

Options are referred to as In-the-Money (ITM), Out-of-the-Money (OTM), or At-the-Money (ATM), depending on where the current market price is compared to the strike price. The option holder can also decide not to exercise at all, even when the expiry date occurs; in which case, the option contract expires, and the holder just loses the premium paid.

Options contracts are divided into American or European style categories. American options contracts allow exercise at any time before expiration, while European options contracts only allow exercise on the expiration date.

Option payoff diagrams provide a visual representation of profit and loss for various option strategies. Below are the option payoff diagrams featuring our hypothetical trader, Jane. Let’s assume the strike price is $100 and the premium is $2.

Long call option. It profits when the market price is above the strike price (plus the premium) because, theoretically, Jane could exercise the option and buy the asset at the lower strike price, then sell the asset at the higher market price. If the market price is below the strike, then Jane would not exercise the option, thus losing the premium paid.

Short call option. Profits are limited to the premium received from selling the option. Losses occur when the market price is above the strike (plus the premium).

Long put option. It profits when the market price is below the strike price (less the premium) because, theoretically, Jane could buy the asset at the lower market price, exercise the option, and sell the asset at the higher strike price. If the market price is above the strike, then Jane would not exercise the option, and thus loses the premium paid.

Short put option. Profits are limited to the premium received from selling the option. Losses occur when the market price is below the strike (less the premium).

Discover the unique aspect of knock-out options, featuring pre-established floor and ceiling levels, commonly referred to as barrier prices. These options automatically terminate or get ‘knocked out’ if the underlying asset’s price touches specific predetermined levels. It’s essential to differentiate this from the strike price, which dictates the buying or selling price when the option holder exercises their rights. The knock-out feature plays a crucial role in managing potential limit profits and losses for both option holders and sellers. Uncover the intricacies of this distinctive option type that can impact your trading strategy.

Unlocking the Potential of Crypto Derivatives: Use Cases Explored

Crypto derivatives play a pivotal role in the financial landscape, primarily serving hedging and speculative purposes.

Hedging: Employed as a risk management strategy, hedging aims to mitigate potential losses in an existing position. For instance, a trader securing Bitcoin (BTC) in the spot market anticipates a price increase. However, to safeguard against potential downturns, the trader establishes a short BTC futures position. This acts as a counterbalance, offsetting losses from the BTC spot position. Alternatively, a long put option with BTC as the underlying asset can also serve as an effective hedge, gaining value if BTC prices decline.

Speculating: Speculation involves predicting asset price movements and entering long or short trades accordingly to capitalize on these predictions. Crypto options and futures, utilizing leverage, amplify potential gains, yet equally magnify potential losses.

Income: Traders may leverage futures and options for income generation, with option sellers receiving premiums from buyers. In crypto perpetual futures, funding rates play a significant role. Long traders may receive payments from short traders at times, while the dynamics reverse in other instances. Traders strategically enter into crypto perpetual futures positions to capitalize on these funding rates.

Conclusion: Navigating the Complex Terrain of Crypto Derivatives

Crypto derivatives, intricate and tradeable financial instruments, cater primarily to advanced traders. Anchored to underlying assets like cryptocurrencies, stocks, bonds, commodities, and forex, these contracts offer exposure to price movements without direct asset ownership. Focusing on futures and options, crypto derivatives find their niche in hedging and speculation.

Determining the suitability of crypto derivatives hinges on factors such as individual trader knowledge, skill, and personal circumstances. As these instruments continue to evolve, a nuanced approach is essential for those considering their integration into their trading strategy.

bayleen vardalos

Kallie Underwood